OACT-Handbook

.

OACT: Order Aggregation (Assembly & Disassembly) System, Product Manual

.

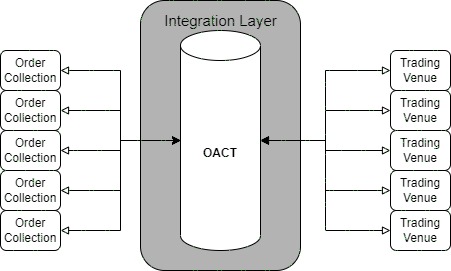

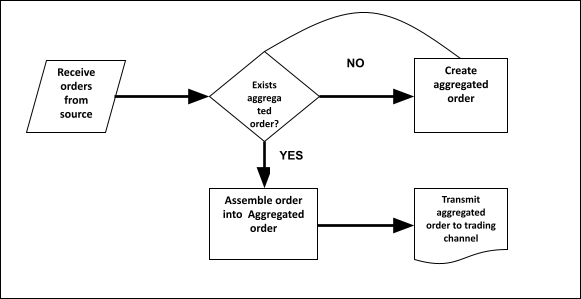

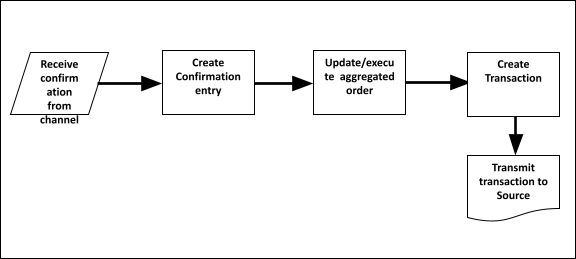

The function of OACT as an unattended order-flow management system is to group incoming Orders from one or multiple sources into batches (“Aggregations”). Instead of transmitting individual orders to one or multiple trading channels ("marketplaces"), these Aggregations are transmitted. When the trading channel has executed the orders, the execution information (e.g. final price, units, dates) is transferred back to OACT as Confirmations, where it is combined with the Aggregations and underlying Orders. Finally, OACT executes the Aggregation and generates new Transactions, corresponding to the original Orders, and transmits these back to the original source. At this point, the transactions and all corresponding data is archived, and is no longer available in the process pipeline. The flow is considered complete.

Although this functionality is not unique, what sets OACT apart is the speed and efficiency at which orders can be processes, far exceeding embedded or other solutions, while consuming substantially fewer resources

OACT : Order->Aggregation->Confirmation->Transaction

OACT is distributed as a single software version, emphasizing a "one version only" approach. Its design prioritizes simple integration, implementation, and user-friendliness, while also being fully functional as a standalone product. The objectives are to provide

- Enterprise-grade efficiency and data integrity

- Portability through simplicity and flexible integration

- Future-proof technology and functionality

The software handles two data-flows, described in more detail in the following pages. Combined, the flows form a pipeline, and when data has passed from beginning to end, it is considered Complete.

The following diagrams provide a general description of the flows within OACT.

Incoming orders and outgoing aggregations

Incoming Confirmations and outgoing transactions

OACT is developed for the purpose of standardizing a common component in Portfolio-management and trading software, as well as crowd-funding and similar applications where multiple smaller orders are grouped into fewer larger orders before presenting them to a channel. The benefits of aggregating orders include:

- Lower trading costs

- Allowing end customers to remain confidential

- Reducing communication and data-transport

- Ensure that all customers are treated equally

- Easier to manage and supervise

Numerous software products dealing with the trading of mutual funds or similar products commonly incorporate an order-aggregation process. However, these processes often possess extensive customizations to accommodate unique use scenarios, are tailored to proprietary software, or rely on connections to peripheral data and functions. Consequently, these practices have resulted in ineffective and non-transferable procedures for a function that could exist independently, or at least exhibit strong portability.

OACT aims to establish a universal benchmark for aggregation-related procedures. Additionally, it enables users to seamlessly transition or enhance their adjacent software systems without the need to revisit, reconfigure, or reengineer the aggregation process. OACT offers complete portability and can be effortlessly incorporated into other systems. Its input and output data structures are adaptable to widely used order flow protocols like FIX and Swift, ensuring compatibility. Furthermore, OACT retains its full functionality even when deployed as a standalone system.

While OACT is primarily crafted as a hands-off, background application, it does come with a graphical user interface (GUI). It's important to note that the GUI is offered as an optional convenience, rather than a core feature of the software.